Electronic Giving

Tithes and Offerings

Options to Contribution

|

New Ways to Support Grace Church

Starting September 1 we are introducing a new method for you to support the church financially. In order to allow those who prefer electronic banking, we will provide a QR code (with texting option) that links to onrealm.org, a service that processes e-giving to Grace’s bank account. To use this method, simply follow these steps: 1. Scan QR code or text GRACESIOUXCITY to 73256 2. Your phone will link to the Grace UMC page at onrealm.org 3. Fill out your credit, debit, or bank account information 4. Specify the amount 5. Your support will go to Grace UMC and appear on your bank or card statement Please note that this number will never send unsolicited texts to you. Standard text message and data rates may apply. We also want to emphasize that this new method will be used in addition to other forms of giving (cash, check, EFT) we currently employ. You are more than welcome to continue using these formats. Thank you to everyone for your generosity! Privacy Policy - https://legal.acst.com/privacy-policy Terms of Service - https://legal.acst.com/terms-service-use Donating IRA Distributions To A Charity

"Qualified charitable distributions (QCDs) have been permanently extended. Individuals can donate up to $100,000 per year directly from a traditional or Roth IRA to qualifying charities. This is attractive to some investors because QCDs can be used to satisfy required minimum distributions (RMDs) from an IRA without having the distribution included in their income." Since the standard deduction has been increased, more taxpayers will be taking the standard deduction which means charitable contributions will no longer be deductible on those Federal Income Tax returns. |

AUTO WITHDRAWL ELECTRONIC GIVING Please consider participating in our program designed to simplify weekly giving in our congregation.

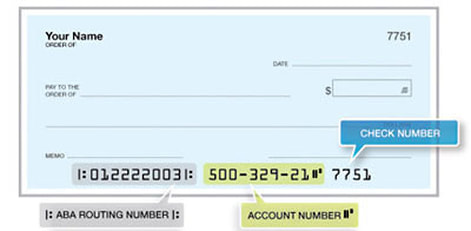

Electronic Giving enables every household or individual to make their church offering using electronic funds transfer (EFT). You may already be using EFT to pay your mortgage, car payment or insurance premium through an automatic withdrawal from your checking or savings account. There is no cost to you for this giving option. If you are currently giving on a weekly basis, you will no longer need to write out 52 checks a year or prepare 52 envelopes. And, when travel, illness or other circumstances prevent you from attending services, this program will allow your weekly offerings to continue on an uninterrupted basis. To participate in electronic giving:

Requires a Free Copy of the Adobe PDF Reader if you do not have a modern browser. Adobe.com. |